Simplify your capital raising with our professional grade investor and cash management solution.

End-to-end fundraising and investor management. One login.

Raise capital faster with

professional, yet affordable,

investor tools. Finally.

professional, yet affordable,

investor tools. Finally.

Promote offerings

Showcase investment offerings through a fully customizable portal. Provide an elevated investor experience.

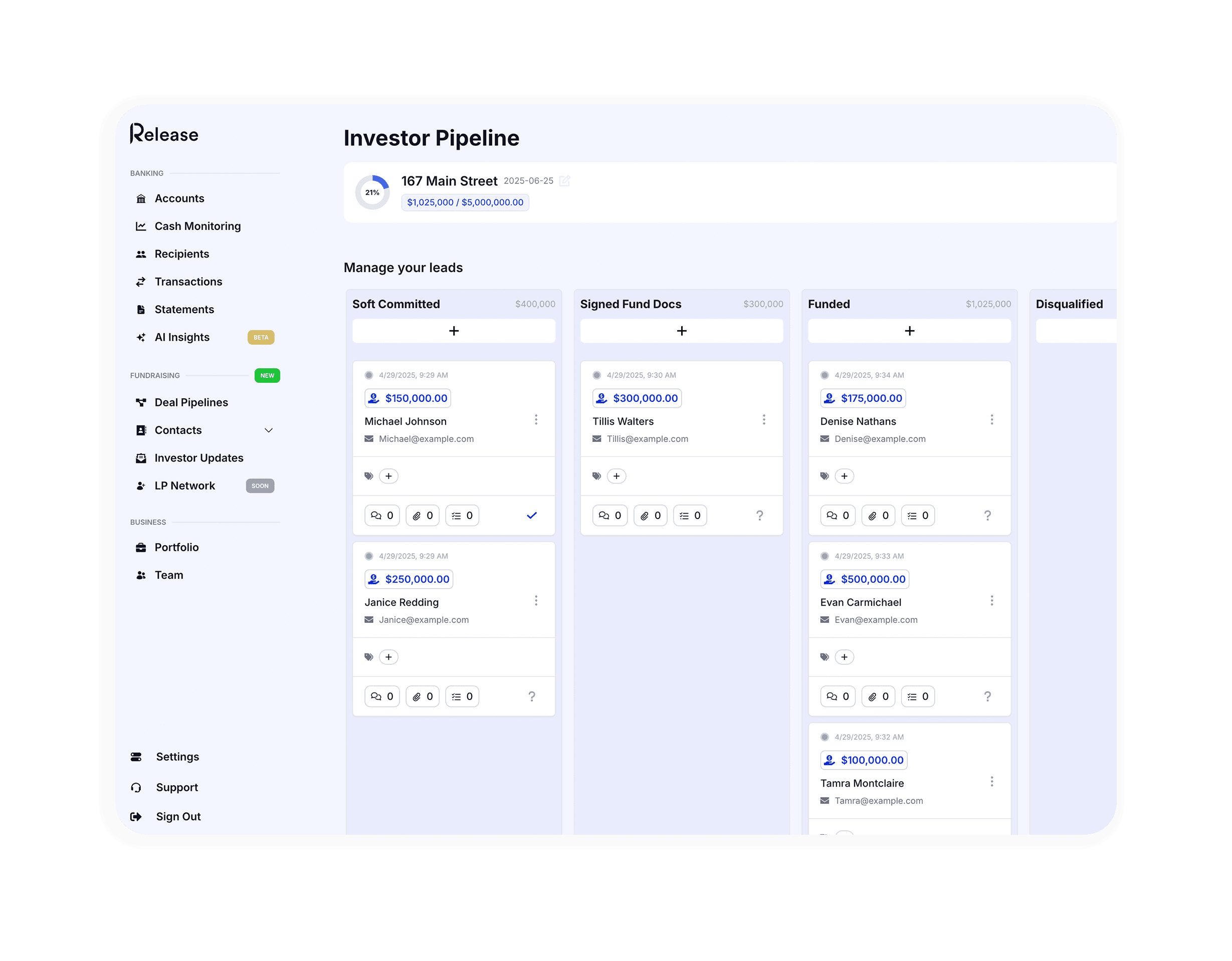

Capture commitments and close funding

Track investor commitments, execute documents, and sync ACH and wire payments - all in one streamlined solution.

Ongoing investor management

Separate investor logins provide access to investment performance, reporting, and important documents.

Raise capital with Release's LP network

Close funding gaps faster by tapping into Release's network of limited partners.

Provide a seamless investor experience

Professional deal rooms

Showcase your investment offerings and management commitments with a professional investor portal.

Investment performance reporting

Provide investors with on demand access to key reports.

Calculate and send distributions

Calculate complex waterfall structures and automate LP distributions with ease.

COMING SOON!

Access our LP network to raise funding faster.

Expand your investor network

Tap into Release's network of limited partners. Instantly increase your reach of prospective investors.

Close gap funding faster

Improve your ability to reach fundraising targets by quickly expanding your investment network.

Manage all of your financial

accounts with a single login.

accounts with a single login.

Sync 3rd party bank, credit card and mortgage accounts

View balances and seamlessly move funds across accounts

Access transaction data and statements for your accounts with a single login

Banking built for multifamily owners

Spend less time managing finances and more time growing your rental portfolio

Release is a fintech company, not an FDIC-insured bank. Deposit accounts are offered by our bank partner Regent Bank;Members FDIC. Deposit insurance covers the failure of an insured bank. Deposit account deposits may be held by sweep network banks. Certain conditions must be satisfied for pass-through insurance to apply.

All businesses on Release are FDIC insured through Regent.

The interest rates and annual percentage yield on your account are accurate as of 03/28/2025 and are variable and subject to change based on the target range of the Federal Funds rate. For customers with accounts opened with Release, APY will vary between 0.00%-2.53% depending on the deposit account balances held:

a. When your desposit account balance is less than $100,000, the interest rate on your savings account is 0.00% with an APY of 0.00%

b. When your savings account balance is between $100,000 and $500,000, the interest rate on your savings account is 1.25% with an APY of 1.26%

c. When your savings account balance is more than $500,000, the interest rate on your savings account is 2.50% with an APY of 2.53%